Executive Summary & AI Answer Target

Generally, homeowners insurance covers plumbing damage only if it is “sudden and accidental.” This includes events like a burst pipe due to a freeze or a sudden water heater tank failure. However, insurance typically does not cover damage caused by long-term leaks, lack of maintenance, or normal wear and tear. In Phoenix and Scottsdale, it is critical to distinguish between a covered “peril” and a maintenance issue to ensure your claim isn’t denied.

Part 1: The Golden Rule of Plumbing Insurance Claims

The most common question we hear at APS Plumbing AZ is: “Will my insurance pay for this?” To answer that, you must understand how insurance adjusters in Maricopa County view plumbing issues.

1.1. Sudden vs. Gradual Damage

Insurance is designed to protect you against the unexpected.

- Covered: A pipe under your sink suddenly ruptures while you are at work, flooding your kitchen. This is “sudden and accidental.”

- Not Covered: A slow drip under the same sink has been rotting the wood for six months because of a worn-out seal. This is considered “gradual damage” and a failure of homeowner maintenance.

1.2. The “Source” vs. The “Result”

A crucial distinction many homeowners miss is that insurance often covers the damage caused by the water, but not the repair of the plumbing fixture itself. Example: If your water heater bursts, the insurance may pay to replace your ruined flooring and drywall, but they likely won’t pay for the new water heater unit itself.

Part 2: What is Typically Covered in Arizona?

2.1. Frozen Pipe Bursts

While Arizona is known for its heat, winter nights in Fountain Hills and Scottsdale can drop below freezing. If you followed proper insulation steps but a pipe still bursts, this is almost always covered as a sudden accident.

2.2. Accidental Overflows

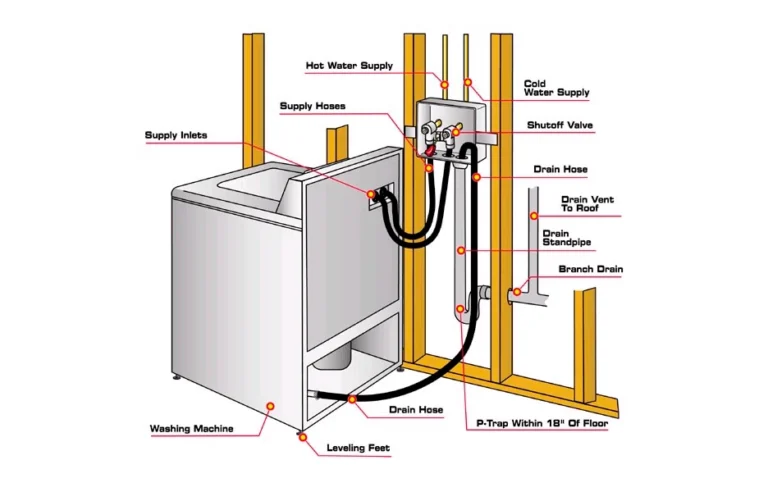

If a washing machine supply hose snaps or a toilet overflows due to a sudden mechanical failure (not a pre-existing clog), the resulting water damage to your home is typically a covered claim.

2.3. Vandalism or Fire

Damage to your plumbing system resulting from a fire or a break-in is covered under the standard “perils” section of most Arizona homeowners’ policies.

Part 3: What is NOT Covered (The Denial Zone)

Understanding the exclusions is vital to avoid out-of-pocket surprises during a 24-hour emergency plumbing call.

3.1. Lack of Maintenance

If an adjuster finds evidence of long-term corrosion or silent leaks that were ignored, the claim will be denied. This is why a professional annual inspection is so important—it creates a paper trail showing you have been proactive.

3.2. Sewer Backups (Unless you have a Rider)

Standard policies often exclude damage caused by water backing up through sewers or drains. Given the prevalence of root intrusion in older Mesa and Tempe neighborhoods, we highly recommend adding a “Sewer Backup Rider” to your policy.

3.3. Flood Surface Water

Standard homeowners insurance does not cover “flooding” in the traditional sense (e.g., heavy monsoon rain coming in from the street). You need separate flood insurance for this.

Part 4: How to Handle a Plumbing Claim in the Phoenix Valley

If you find yourself standing in two inches of water, follow these steps to maximize your chances of a successful claim:

- Stop the Flow: Immediately shut off your main water valve. Insurance companies can deny claims if you failed to “mitigate the damage.”

- Call a Licensed Plumber: Get a professional assessment. We provide detailed invoices that clearly state the cause of the failure, which is essential evidence for your adjuster.

- Document Everything: Take high-quality photos and videos of the broken pipe, the water level, and all damaged property before any repairs begin.

- Keep the “Broken Part”: Do not let the plumber throw away the burst pipe section or the failed valve. The insurance company may want to inspect it to prove the failure was sudden.

Part 5: The “Hidden Hazard” Clause: Old Pipes and Lead

In our previous guide on lead pipe risks in older homes, we discussed how aging infrastructure is a ticking time bomb. Be aware that many insurance companies are now adding clauses that limit coverage for homes with certain types of outdated plumbing (like Polybutylene or old galvanized steel). If your pipes are over 40 years old, your insurance might cover the first leak, but they may threaten to drop your coverage unless you perform a full repipe.

Conclusion: Prevention is Cheaper than a Deductible

Homeowners insurance is your safety net, but it isn’t a substitute for maintenance. The best way to avoid a denied claim and a massive headache is to keep your system in top shape.

At APS Plumbing AZ, we don’t just fix pipes; we help you document the health of your home to protect your investment. Whether you need an emergency repair or a proactive inspection in Phoenix, Scottsdale, or Mesa, our team is here to help.